In the quickly evolving digital money era, Saudi investors are increasingly ambitious and inquisitive about joining crypto markets. Nevertheless, one of the greatest hurdles for most beginners is finding out how to read crypto charts. These charts are extremely valuable possessions that can aid your decisions and allow you to trade with increased confidence and tactics.

Whether you’re completely new or simply want to refine your skills, this tutorial will walk you through how to read an English crypto chart simply, step-by-step, and in practice so, that you can continue your trading journey with confidence.

Table of Contents

Why Crypto Charts Matter

Crypto charts are not pretty colors and pretty bars; they are graphical stories of what the market is communicating. They reflect:

- Price action through time

- Condensed trading volume

- Market mood

- Likely opportunities and risks

Being able to interpret how to read these signals is of immense benefit to traders. It moves you away from guesswork and towards smarter, better-educated trading decisions.

The Basics: What a Crypto Chart Shows

Most crypto charts focus on two main points: price and time.

On any standard chart:

- The X-axis is used to plot time: minutes, hours, days, weeks, or months.

- The Y-axis (vertical axis) is price: how much the cryptocurrency is worth at any given moment.

Each movement of the chart tells you whether buyers (the bulls) or the sellers (the bears) are in control.

Popular Types of Crypto Charts

Before diving deeper, let’s quickly look at the main types of crypto charts you will encounter:

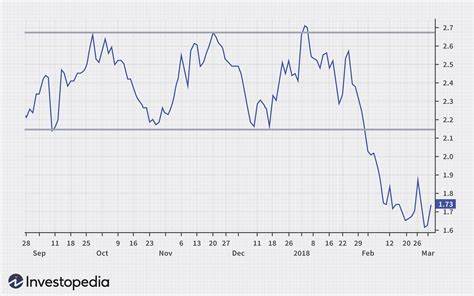

1. Line Charts

- Easiest to read.

- Graphs the closing prices over time.

- Good for seeing the overall trend.

When to use: When you want a quick look without too much detail.

2. Bar Charts

- Show opening, closing, high, and low prices for a period.

- The vertical line for each trading period.

When to use: When you want a clearer idea of how price action developed during each period.

3. Candlestick Charts

- Most popular among traders.

- Each “candlestick” depicts open, high, low, and close prices.

- Green candles generally mean price went up; red candles mean price went down.

When to use: For detailed technical analysis and determining market trends.

How to Read a Candlestick Chart: Step-by-Step

Candlestick charts look intimidating at first sight, but if you break them down, they’re quite logical. Here’s how to read them:

- Master the Anatomy of a Candle

•Body: The plump middle bit shows the range between the opening and closing price.

•Wicks (or shadows): Thin lines above and below the body show the high and low prices.

•Color: Determines direction of the market.

Example:

If the body is green and tall, the buyers dominated at that time. If the body is red and short, the sellers had minor dominance but without high strength. - Spot Trends

• Uptrend: String of green candles with higher highs.

• Downtrend: String of red candles with lower lows.

• Sideways trend: Candles moving sideways without clear direction (also known as “consolidation”).

Spotting trends enables you to make more educated trading decisions by going with the momentum rather than against it. - Find Support and Resistance

•Support: Price level at which interest in buying is strong enough to stop the fall.

•Resistance: Price level at which interest in selling is strong enough to stop the advance.

These can play like a system of invisible walls on the chart. The price will “rebound” off these levels. - Identify Candle Patterns

Candle patterns can provide a lot of clues about future price actions.

These are some general shapes to get you started:

- Doji: Candle that has a hardly their body indicates indecision.

- Hammer: Short top body and extensive lower wick potential trend reversal upward.

- Shooting Star: Short bottom body and extended upper wick potential trend reversal downward.

By learning a few of the basic patterns, you are made aware of potential changes in the market early on.

Read More: How to Avoid Common Crypto Scams in the Middle East

Timeframes: Choosing the Right One

Crypto graphs can be shifted to different time frames, such as:

• 1 minute graphs: Extremely high-speed trading

• 5 minute through 1-hour graphs: Ideal for short-term traders

• 4 hour through daily graphs: Ideal for swing traders

• Weekly graphs: Ideal for long-term investors

Tip: Newbies tend to prefer longer time frames (e.g. daily or weekly graphs). They depict smoother trends and eliminate the noise of quick price movements.

Indicators: Adding Extra Power to Your Analysis

Along with price action reading, you can also employ technical indicators to refine your analysis. Some easy-to-use indicators for newbies are:

- Moving Averages (MA)

•Simple Moving Average (SMA): Average price over a set number of periods.

•Exponential Moving Average (EMA): Same but reacts faster to price action.

Use: Determine trend direction.

If price is above the moving average, the trend is rising. If below, the trend is falling.

Read Also: How to Use Binance in Saudi Arabia – Step-by-Step for New Traders

2. Relative Strength Index (RSI)

- Measures if a coin is oversold or overbought.

- RSI greater than 70: Overbought (likely price drop).

- RSI less than 30: Oversold (likely price rise).

Use: Time your entries and exits better.

3. Volume

- Shows how much of the coin has transacted during an interval.

- Volume rising with price rise = strong trend.

- Volume falling with price rise = likely weak trend.

Application: Confirm if a trend has genuine power.

Common Mistakes to Avoid

It is a process of learning to read crypto charts. Observe these newbie mistakes:

- Making the chart too complex: It needs to be simple. Too many indicators confuse.

- Losing perspective: Always go back and check the big picture.

- Emotional decisions: Never make decisions in fear or greed.

- Chasing pumps: Don’t rush into an instant pump; hesitate before analysis.

- Risk management forgetting: Always decide in advance how much you are willing to risk.

Patience, discipline, and continuous learning are your best friends.

Practice Makes Progress

Reading crypto charts is like acquiring a language. At first, it is strange and intimidating, but with regular practice, you adapt.

Start by:

- Looking at real charts every day (even if you’re not trading).

- Learning trends, support, and resistance.

- Watching patterns as they form and see how price acts.

You don’t need to be great; you need to be consistent.

Materials to Help You Practice

Some practice sites where you can read crypto charts for free are:

- TradingView: Free charting software with plenty of features.

- Binance: Their “spot” trading section shows live charts.

- Investopedia: Offers newbie lessons in chart reading.

Combining book knowledge with hands-on experience is the fastest way to become skilled at this activity.

Final Thoughts: Building Confidence Through Clarity

For Saudi traders, being able to read an English crypto chart is not just a trading skill — it’s a smart and assertive means of engaging with global financial markets.

The digital economy is growing rapidly and having an understanding of how markets move from charts empowers you to navigate it successfully.

Instead of relying on luck, you rely on your own data and analysis.

Remember:

- Keep it simple.

- Keep it clear.

- Grow at your own pace.

- Reflect on every trade, win or lose.

Practice, patience, and time will see you reading crypto charts like a pro — opening doors and opportunities for your financial future.

It’s all about beginning with just one chart. Open one today and look at the market with new eyes.