Table of Contents

In the extremely volatile and highly unpredictable world of cryptocurrency trading, a glimpse into how markets work is crucial to making smart decisions. In the most trusted and well-known professional traders’ tool kit is the Fibonacci retracement. As straightforward as it might look on the surface but extremely advanced in implications, this technique employs a basic mathematical sequence and can prove to be a great ally in the right hands.

Regardless of whether you’re new or want to enhance your trading method, this guide will walk you through how to use Fibonacci retracement in crypto trading step-by-step, and the right way.

Read Also: How To START a CRYPTO trading WITHOUT losing your mind or money

WHAT is fibonacci retracement

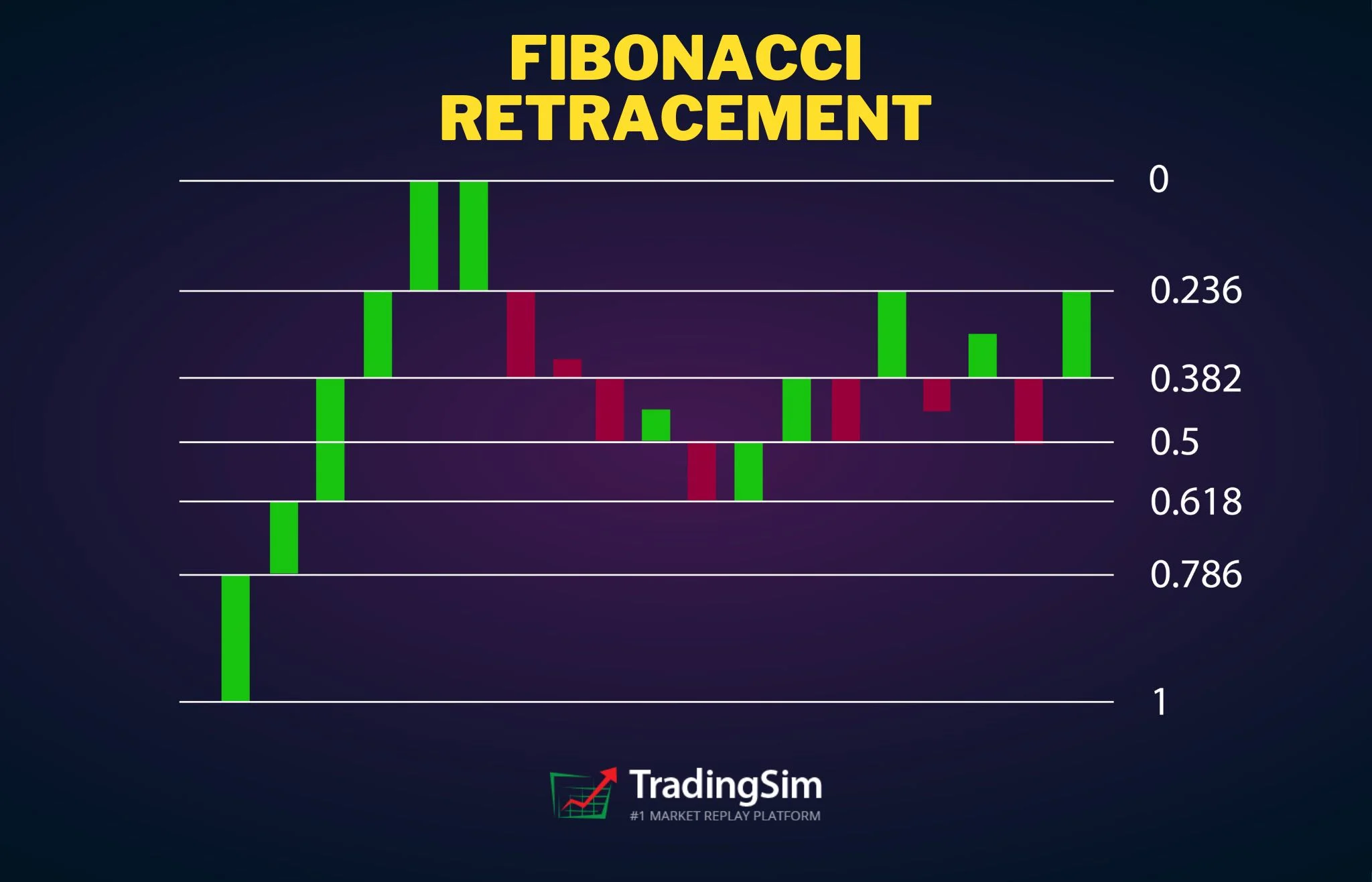

Fibonacci retracement is a technique of technical analysis based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding numbers (1, 1, 2, 3, 5, 8, 13, etc.). Traders take some important ratios 23.6%, 38.2%, 50%, 61.8%, and 78.6% from this series, which are then used to predict possible support and resistance levels on price charts.

These levels assist traders in knowing where the price may halt, reverse, or consolidate, providing them with improved entry and exit points.

Why Fibonacci Retracement Works in Crypto Trading

Cryptocurrency markets, like any financial market, are governed by human emotion such as hope, fear, indecision, and greed. Because these emotions will recycle, trends will develop. Fibonacci retracement works because it applies natural ratios, and this makes it useful in predicting probable turning points.

In volatile markets like crypto, traders employ Fibonacci levels to:

- Recognize pullbacks in existing trends

- Identify price consolidation areas

- Set stop loss and take profit with higher accuracy

How to Draw Fibonacci Retracement Levels

To apply Fibonacci retracement, you first need to know how to do it on a chart. Most charting software has a built in Fibonacci tool, like Trading View or Binance.

Step-by-Step Instructions:

1. Choose a Trend: Choose a recent good price action either bullish (up) or bearish (down).

2. Choose the Tool: In your charting software, choose the Fibonacci retracement tool.

3. Label the Swing Points:

- In an uptrend, click at the swing low and drag to the swing high.

- In a downtrend, reverse: click at the swing high and drag to the swing low.

4. Analyze the Levels: The tool will display the key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) between the two points.

These levels are the levels of reference on which price can potentially retrace before continuing the trend.

Understanding the Key Fibonacci Levels

Each Fibonacci level has its specific job of signaling the price action to the traders:

- 23.6% Level: Secondary retracement. It usually shows robust movement in the existing trend.

- 38.2% Level: Medium retracement, widely used as a means of verifying trend strength.

- 50% Level: It is not a Fibonacci figure, but it’s fashionable. Most traders expect a 50% pullback before continuation.

- 61.8% Level: The “golden ratio.” If price bounces off here, it generally means the continuation of the current trend.

- 78.6% Level: Deepest retracement. If price remains here, it’s generally the last strong support/resistance before a outright reversal.

Real World Example: Using Fibonacci in an Uptrend

Let’s say a crypto like Ethereum drops from $1,800 to $1,200. You believe that the price will correct itself before going higher. That’s how you would use Fibonacci retracement:

- Take the instrument between $1,200 (swing low) and $1,800 (swing high).

- The 38.2% level is around $1,560.

- The 61.8% level is around $1,380.

If Ethereum retreats to $1,560 and shows signs of support (e.g., high volume or bullish candles), then that would be a good level to enter a long position, hoping that the trend will continue upwards.

Combining Fibonacci with Other Indicators

Although Fibonacci retracement is robust, it becomes even more robust when supported by other technical indicators. Some of these supporting tools are:

- Moving Averages

A strong Fibonacci level that coincides with a 50 day or 200 day moving average becomes even more believable. - RSI (Relative Strength Index)

An oversold RSI on a robust Fibonacci level may be the first sign of a potential reversal. - Candlestick Patterns

Bullish or bearish patterns at the Fibonacci levels act to confirm market sentiment. A few examples are hammer candles, doji, or engulfing patterns. - Volume

Greater volume at a retracement level confirms strong buyer or seller interest, and a bounce or reversal is more likely.

Avoiding Common Mistakes

Applying Fibonacci retracement in the right way needs patience and discipline. Here are typical mistakes to steer clear of:

❌ Solely Dependent on Fibonacci

Avoid treating Fibonacci levels like magic figures. Always support it with other indicators.

❌ Wrong Placement of Swing Points

Placing the high and low incorrectly will provide incorrect retracement levels.

❌ Forgetting the Overall Picture

Zoom out to longer periods (e.g. Daily or weekly charts) to get a better view of the general direction before using Fibonacci levels.

❌ Trades Without a Plan

Even if a Fibonacci level is attractive, always establish well defined entry, exit, and stop loss points with risk management in mind.

Best Practices for Using Fibonacci the Right Way

Below are some pro tips to improve your trading success with Fibonacci retracement:

- Apply it in Trending Markets: Fibonacci works best when there is a definite trend. Don’t use it in choppy or sideways markets.

- Match with Timeframes: Use the retracement tool on larger timeframes (1D, 4H) for more reliable signals.

- Locate Confluence: When multiple indicators or chart patterns are converging on a Fibonacci level, the chances of the trade working are higher.

- Respect Risk Management: Never trade with Fibonacci alone. Protect your capital with well calculated stop losses.

When to exit the trade

Fibonacci levels are not only to use when you go in using them to exit too. You’re taking a trade in at, say, the 61.8% retracement level and the price starts going up. You can check:

- Prior swing highs

- Extension levels such as 1.618 or 2.618

- Fibonacci expansion aids for predicting take profit levels

This is how you can realistically budget for profits instead of working on emotions.

Fibonacci Extensions: A Bonus Tool

Once the retracement is finished and the price re-establishes its trend, the Fibonacci extensions can be utilized to forecast how far the trend would extend.

Most commonly applied extension levels are:

- 1.272

- 1.618 (yet another golden number)

- 2.618

These are particularly helpful in setting profit taking levels in trending markets.

Conclusion

Fibonacci retracement is not charting lines, it’s a methodical way of discovering structure in disorderly markets. Used correctly, it can guide your choices with clarity and confidence. The secret is to make use of the tool with sound analysis, patience, and the ability to see what the market trend is.

In the ever-evolving world of crypto, staying current and adhering to a disciplined method can be the difference between the waves and everything else. Fibonacci retracement gives you a good method for riding the waves of market momentum with more confidence and less stress.

So, the next time you are looking at a crypto chart, just take the time to plot those Fibonacci lines. You might notice a whole new level of conviction in your trades.